38 yield to maturity of a coupon bond formula

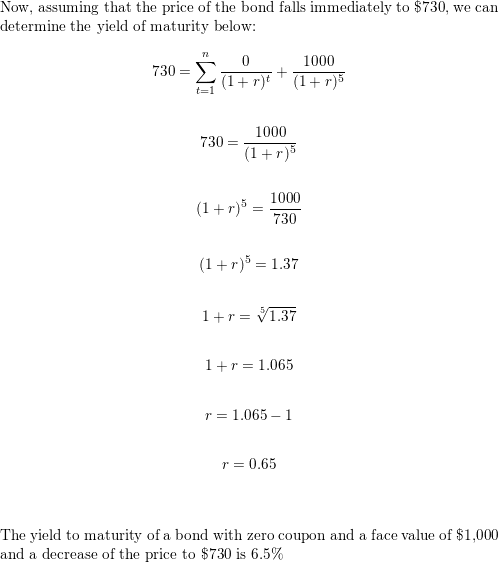

Yield to Maturity (YTM) - Overview, Formula, and Importance 7.5.2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ... › bond-equivalent-yieldBond Equivalent Yield Formula | Step by Step Calculation The first part talks about the face value and the purchase price. In short, the first part depicts the return on investment for the investor. For example, if an investor pays $90 as a purchase price for the bond Price For The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption ...

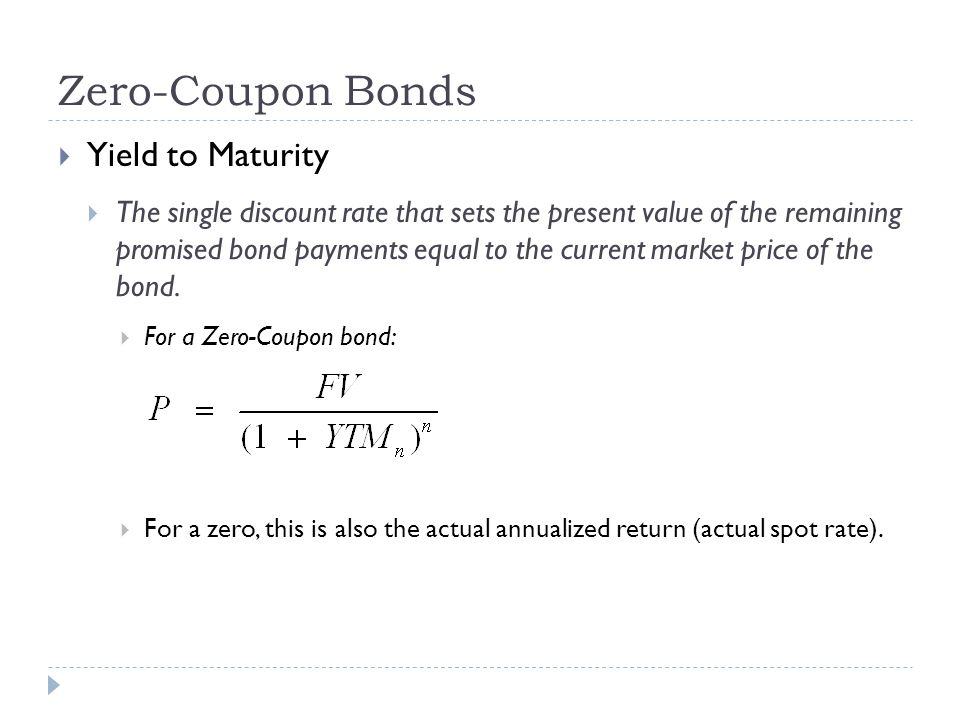

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Yield to maturity of a coupon bond formula

Bond Yield Calculator Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: corporatefinanceinstitute.com › resourcesYield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is the …

Yield to maturity of a coupon bond formula. › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Price Calculator | Formula | Chart 20.6.2022 · It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A ... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Where: Price+1%: Bond price when yield increases by 1% Price-1%: Bond price when yield decreases by 1% Price: Current trading price Δyield: Percentage point change in yield (note that it's squared; sign doesn't matter) But – stick with the better convexity formula if you have time to calculate it (or come back and visit this page!). How to Calculate Yield to Maturity: 9 Steps (with Pictures) 6.5.2021 · Yield to Maturity (YTM) for a bond is the total return, ... Plug the yield to maturity back into the formula to solve for P, the price. ... , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into ...

› blog › all-you-need-to-know-aboutYield to Maturity (YTM): Formula, Meaning & Calculation Price = Current Market Price of the Bond; Maturity = Time to Maturity i.e. number of years till Maturity of the Bond; Yield to Maturity Calculation of a Bond: How it is Done. Yield to Maturity (YTM) acts as an indicator of potential returns from a Debt Fund, hence understanding how it gets calculated is the key to getting a grip on how it will ... › Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Use the formula = (((/ (+))) /) + / ((+)), where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Yield to Maturity Calculator | Calculate YTM 14.7.2022 · The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and; n - Years to maturity. Let's take Bond A issued by Company Alpha, which has the following data, as an example of how to find YTM: Bond price ...

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Compute Convexity Based on Yield to Maturity. Ensure the "You Know Yield to Maturity" button is depressed if you'd prefer to enter the bond's par value and yield to maturity to compute convexity. Calculator Inputs. Bond Face Value/Par Value ($) - The par or face value of the bond. Years to Maturity - Years that are left until the bond matures. Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM): Formula, Meaning & Calculation - ET … Price = Current Market Price of the Bond; Maturity = Time to Maturity i.e. number of years till Maturity of the Bond; Yield to Maturity Calculation of a Bond: How it is Done. Yield to Maturity (YTM) acts as an indicator of potential returns from a Debt Fund, hence understanding how it gets calculated is the key to getting a grip on how it will ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is the …

corporatefinanceinstitute.com › resourcesYield to Maturity (YTM) - Overview, Formula, and Importance May 07, 2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ...

Bond Yield Calculator Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 yield to maturity of a coupon bond formula"