39 treasury bill coupon rate

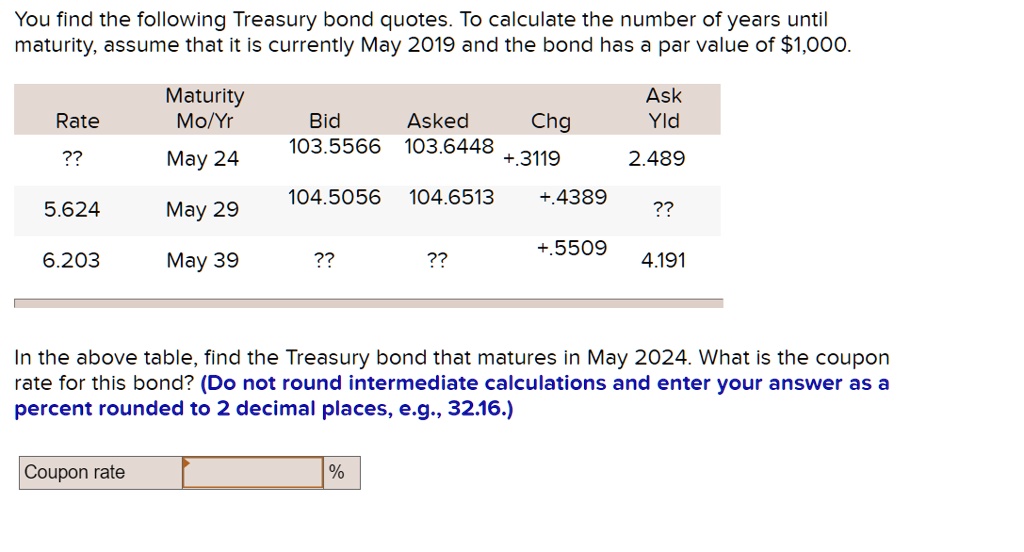

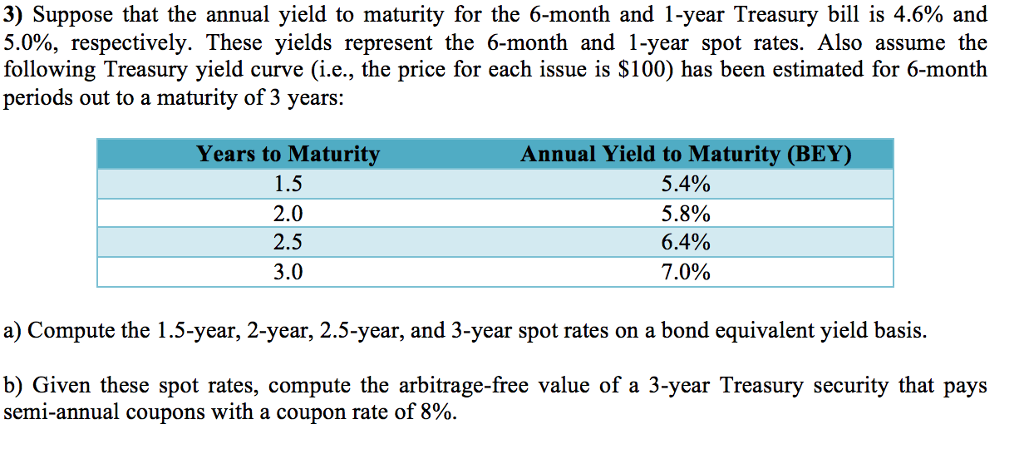

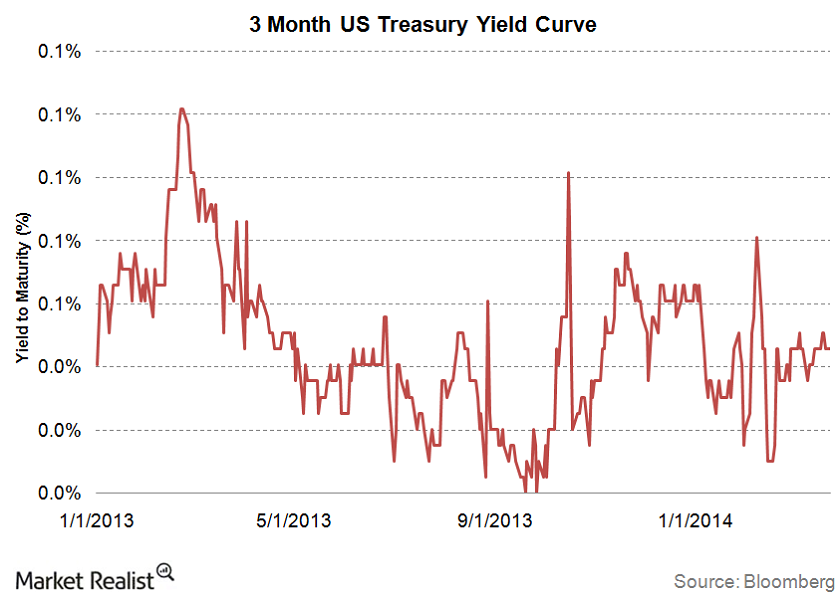

How the Treasury Market Predicts and Influence Interest Rates - The New ... Another Treasury note, the two-year, which is seen as more reflective of Fed moves, rose from 0.73 percent at the end of December to 1.86 percent on March 15. It stood at 4.55 percent on Tuesday ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Foreign Account Tax Compliance Act | U.S. Department of the Treasury Nov 01, 2022 · FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with the …

Treasury bill coupon rate

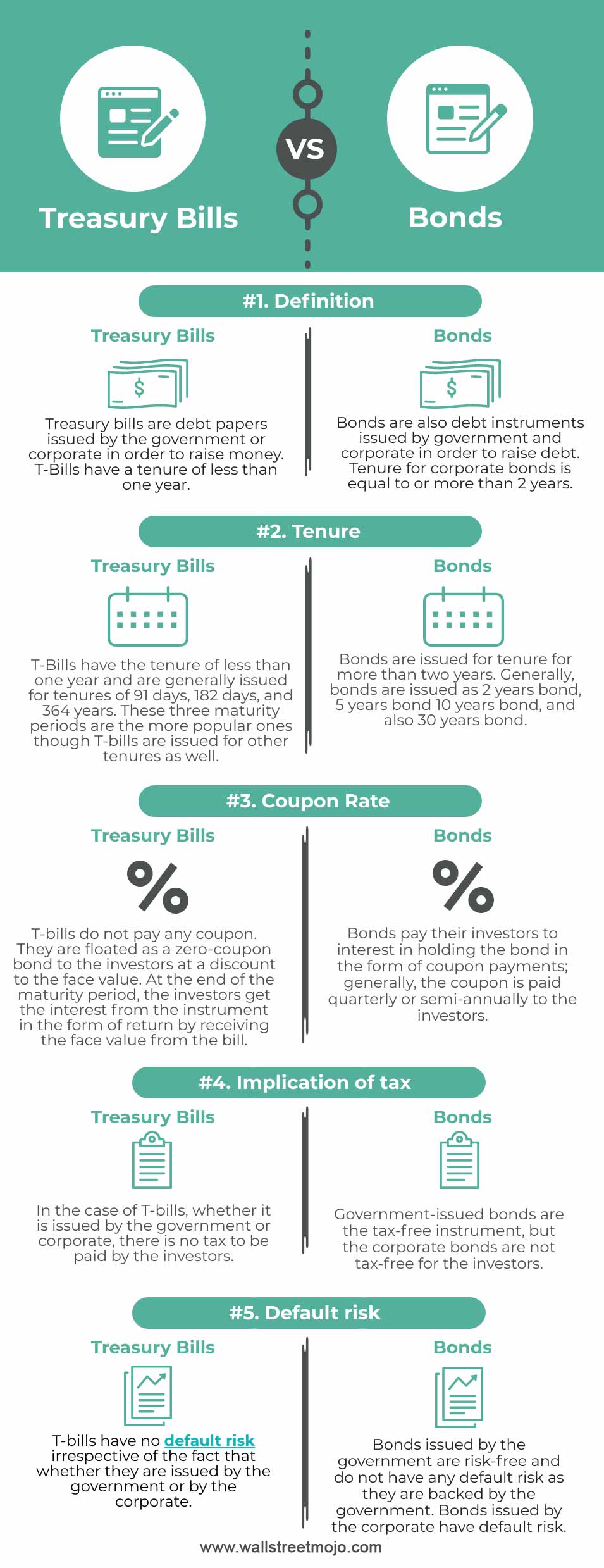

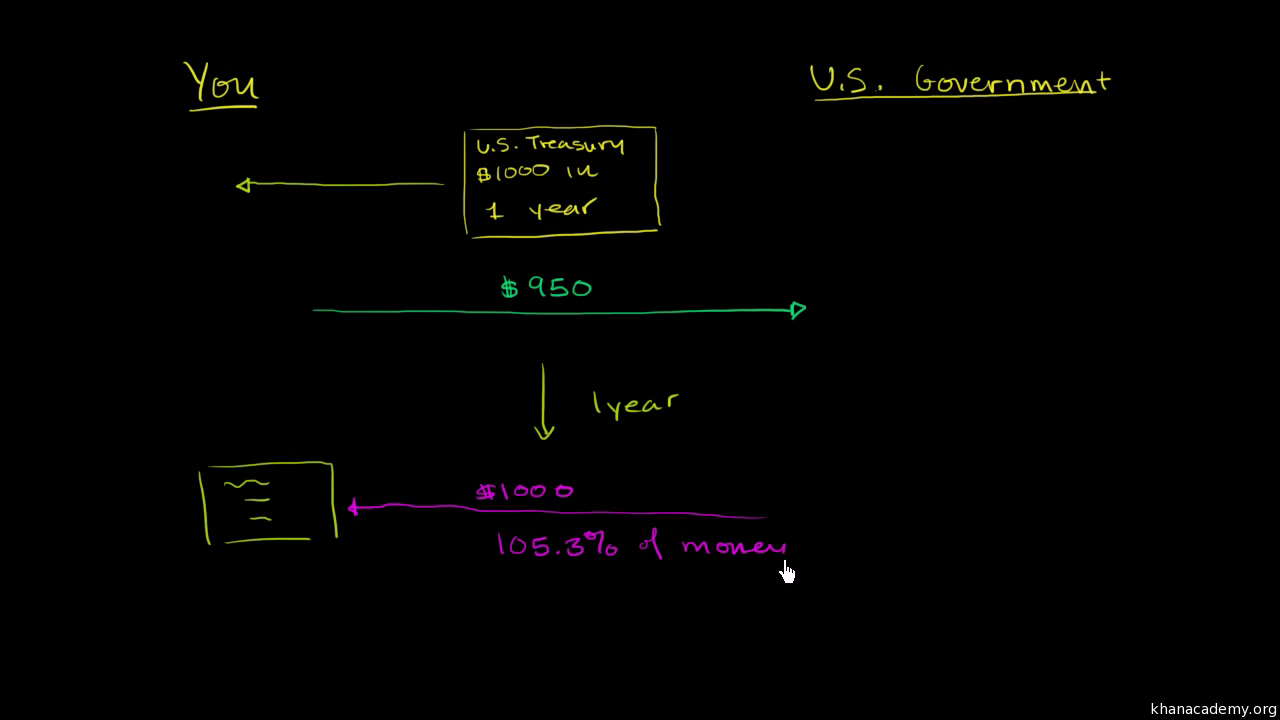

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Bank Discount Rate Definition - Investopedia To simplify calculations when determining the bank discount rate, a 360-day year is often used. 360/270 = 1.33 Finally, multiply both figures calculated above together. 3% x 1.33 = 3.99% The... Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America's Finances. Monthly Treasury Statement.

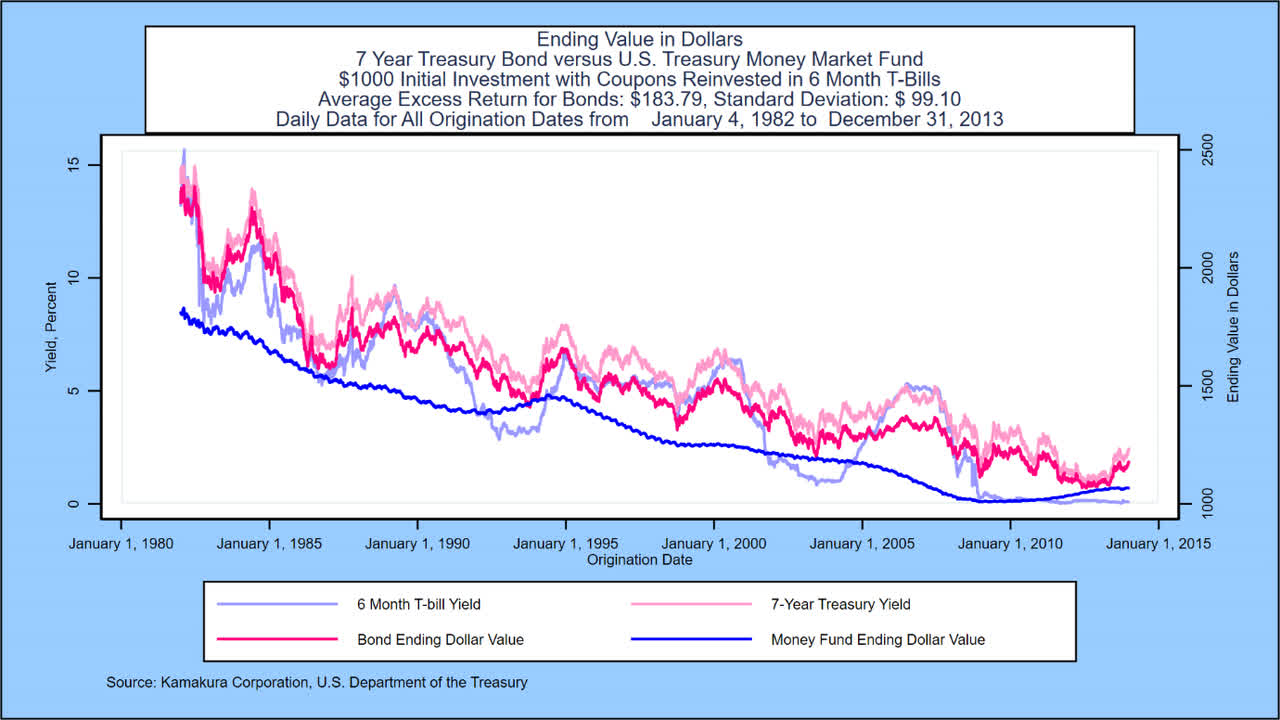

Treasury bill coupon rate. Interest Rate Statistics | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... View the Daily Treasury Bill Rates ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30 ... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Stock Quotes, Business News and Data from Stock Markets | MSN … Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S....

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Nov 04, 2022 · Coupon 2.75%; Maturity 2032-08-15; Latest On U.S. 10 Year Treasury. ... Yield on 2-year Treasury note hits highest level since July 2007 as markets absorb Fed rate hike November 3, ... Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week. Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... Treasury Bill Rates, Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. View This Data. Daily Treasury Par Yield Curve CMT Rates. 11/04/2022. 1 Month . 3.73.

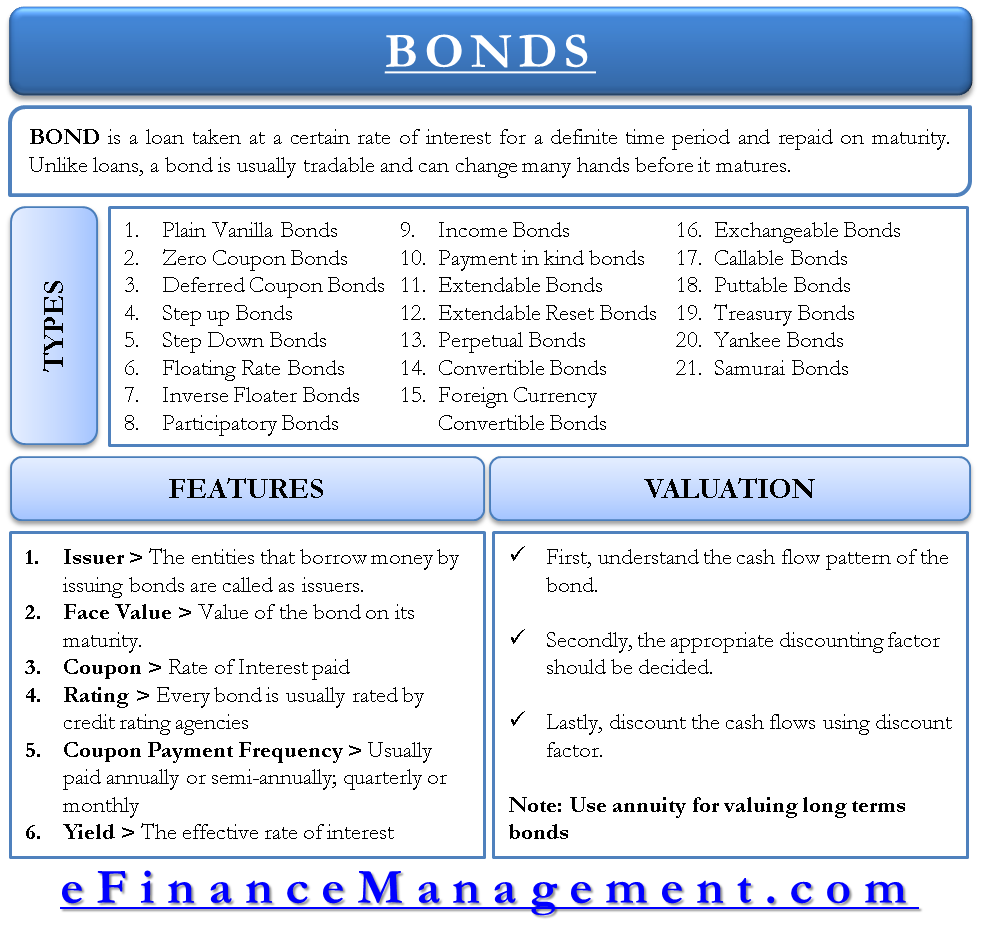

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Nov 2, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Traders are evenly split on size of December rate hike heading into Fed's... 6 Month Treasury Bill Rate - YCharts The 6 month treasury yield reached nearly 16% in 1981, as the Fed was raising its benchmark rates in an effort to curb inflation. 6 Month Treasury Bill Rate is at 4.45%, compared to 4.46% the previous market day and 0.07% last year. This is lower than the long term average of 4.48%. Report. H.15 Selected Interest Rates. Category. Interest Rates. Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors Do Treasury bills pay interest? - KnowledgeBurrow.com Every six months, treasury notes pay out an amount equal to half of their "coupon rate." Here's an example: say you have a $10,000 ten year treasury note with a coupon rate of 4.25%. They also have a coupon payment every six months and they also are valued at their face value upon maturity. How often is interest paid on a Treasury bill?

Treasuries - WSJ U.S. Treasury Quotes Friday, November 04, 2022. Treasury Notes & Bonds; Treasury Bills; Loading... We are in the process of updating our Market Data experience and we want to hear from you.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face value. 9 In other words, it would cost approximately $970 for a $1,000 T-bill. What...

Treasury's Certified Interest Rates — TreasuryDirect About Treasury Marketable Securities Treasury Bills Treasury Bonds Treasury Notes TIPS Floating ... Quarterly Interest Rate Certification Semi-Annual Interest Rate Certification Annual Interest Rate Certification Continued Treasury Zero Coupon Spot Rates Average Interest Rates on U.S. Treasury Securities UTF ... Treasury's Certified Interest ...

Treasury Notes — TreasuryDirect We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature. You can hold a note until it matures or sell it before it matures. Notes at a Glance Latest Rates 10-Year Notes See All Rates How do I ... for a note Buy a Treasury marketable security

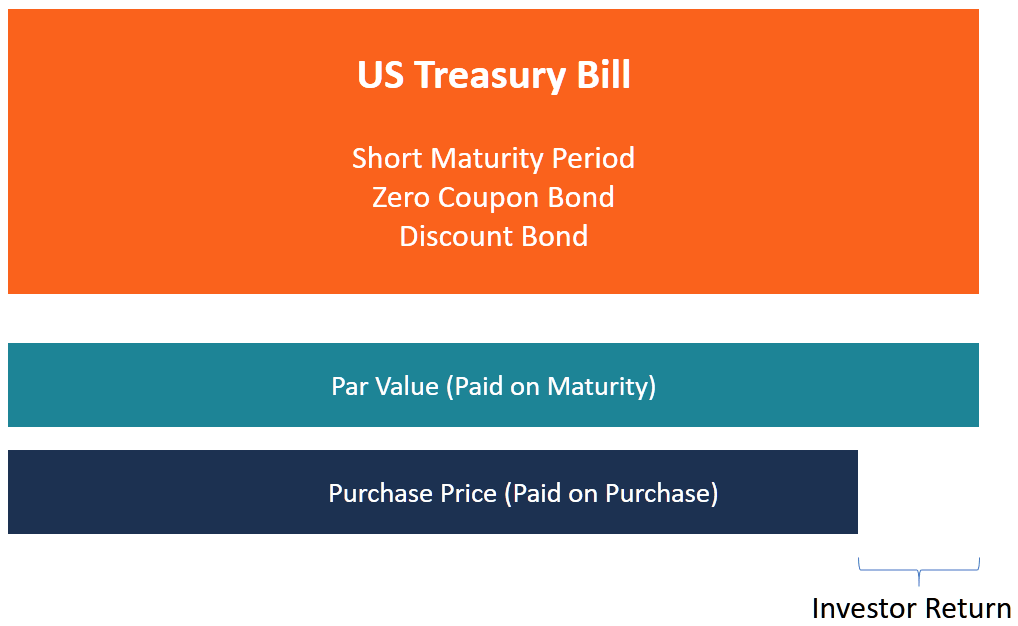

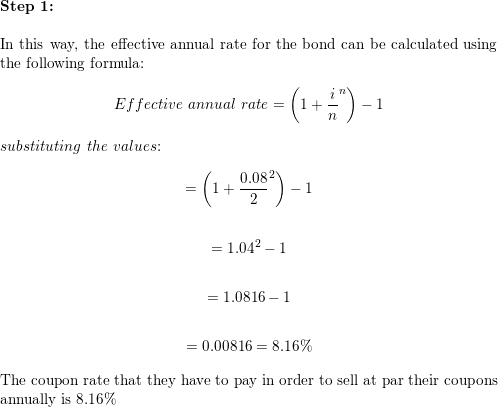

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Coupon Equivalent Rate (CER) Definition - Investopedia Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96. Compared with a bond paying an 8% annual coupon we'd choose the...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Treasury Bill Rates - Nasdaq The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also...

How Are Treasury Bill Interest Rates Determined? - Investopedia The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face...

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different …

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

Resource Center | U.S. Department of the Treasury Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America's Finances. Monthly Treasury Statement.

Bank Discount Rate Definition - Investopedia To simplify calculations when determining the bank discount rate, a 360-day year is often used. 360/270 = 1.33 Finally, multiply both figures calculated above together. 3% x 1.33 = 3.99% The...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

Post a Comment for "39 treasury bill coupon rate"