45 what is the coupon rate of a bond

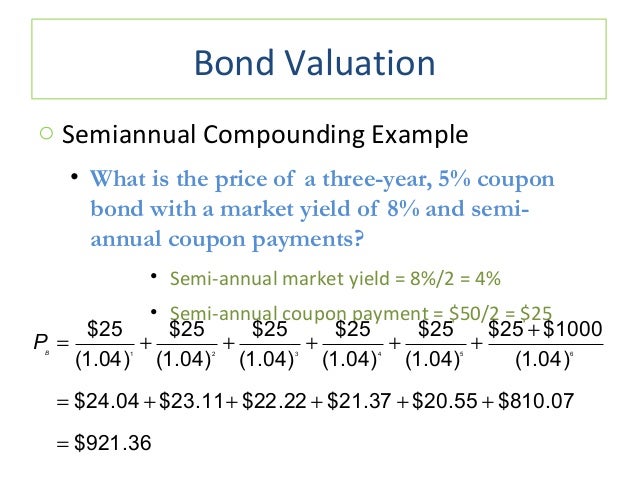

What Is a Callable Bond? Definition & Types | Arena | news-daily.com The issuer of a traditional bond must make a set number of coupon (interest) payments to the bondholder over the course of the bond's term, then return the face value (principal) of the bond to ... Solved What is the coupon rate of a two-year, $5,000 bond - Chegg What is the coupon rate of a two-year, $5,000 bond with semiannual coupons and a price of $4,875.92, if it has a yield to maturity of 6.3% A. 3.968% B. 5.952% C. 6.944% D. 4.96%

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

What is the coupon rate of a bond

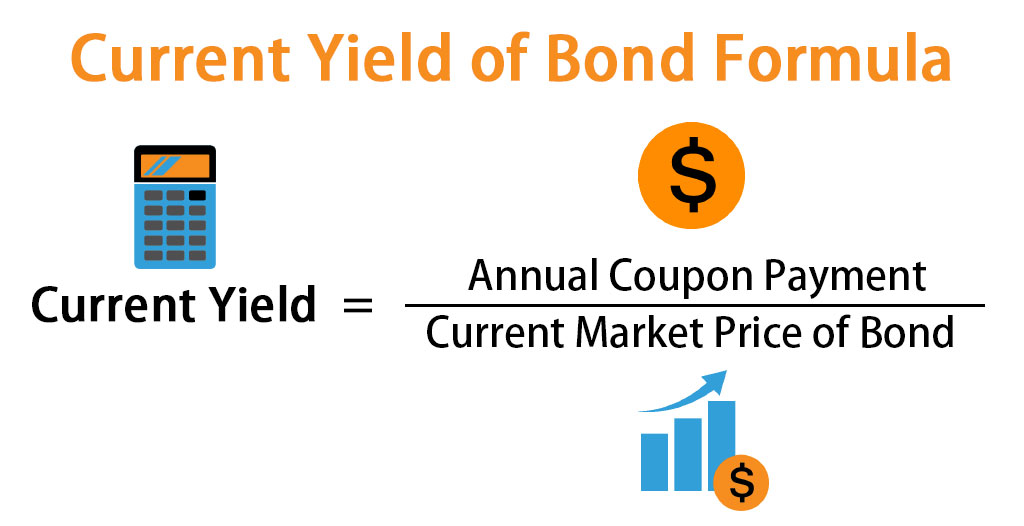

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond.Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

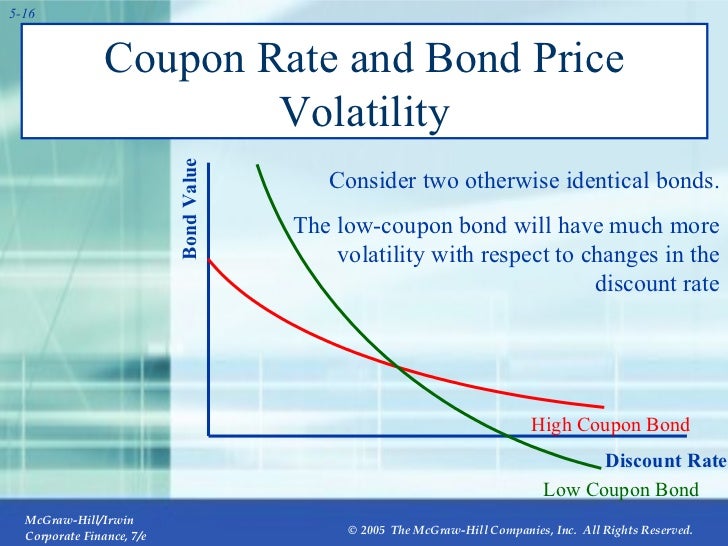

What is the coupon rate of a bond. Coupon Rate Of A Bond Formula Definition Calculate Coupon Rate Value of sum value bond of coupon the face coupon as par dividing amount of of the is also rate rate- be by bond- the be mathematically represented interest 100 Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Step-Up Notes with Increasing Coupon Rate. Another security that has a unique coupon structure is step-up bonds. These are bonds that have a coupon rate that increases over time. For example, a 5-year step-up bond of the par value of USD 100.00 may have a coupon rate of 5% for the first 3 years and 7% for the last two years. What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder. What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50 Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond?

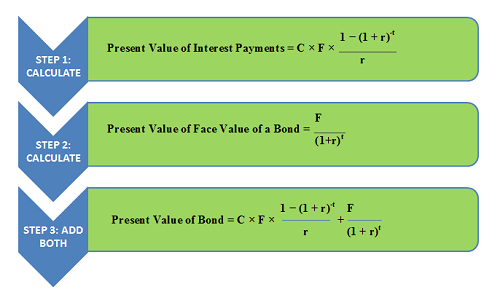

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. How to Calculate the Price of Coupon Bond? - WallStreetMojo The company plans to issue 5,000 such bonds, and each bond has a par value of $1,000 with a coupon rate of 7%, and it is to mature in 15 years. The effective yield to maturity is 9%. Determine the price of each bond and the money to be raised by XYZ Ltd through this bond issue. Below is given data for the calculation of the coupon bond of XYZ Ltd.

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What is Nominal Yield? - Realonomics The nominal yield is simply the coupon rate. of a bond. It is the interest rate that a bond issuer will promise to pay to the bondholders. The rate is usually fixed over the life of the bond. Although the nominal yield is an annual percentage, it does not necessarily represent the realized annual return of a bond.

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Interest and Yield for eTBs | australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Post a Comment for "45 what is the coupon rate of a bond"