39 are zero coupon bonds taxable

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org One last thing you should know about zero-coupon bonds is the way they are taxed. The difference between the discounted amount you pay for a zero-coupon bond and the face amount you later receive is known as "imputed interest." This is interest that the IRS considers to have been paid, even if you haven't actually received it.

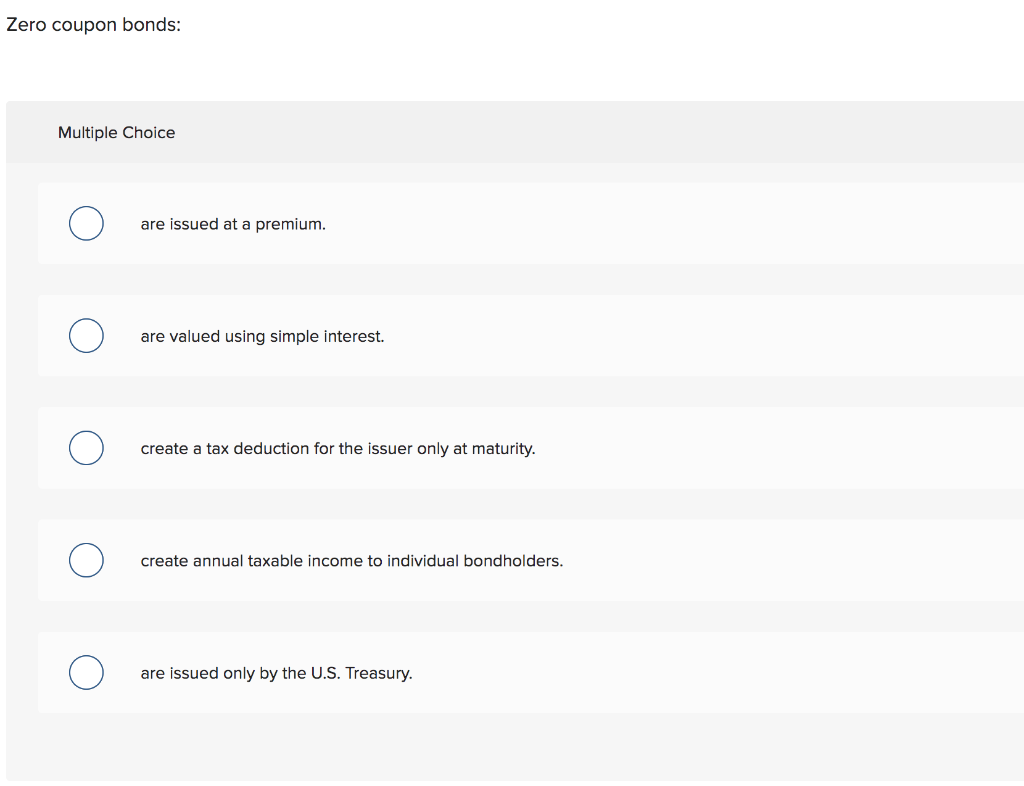

The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes.

Are zero coupon bonds taxable

How is tax calculated on a zero coupon bond? - Quora Do you pay taxes on zero coupon bonds? Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. What is the tax implication on zero coupon bonds? - myITreturn Help Center Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Tax Considerations for Zero Coupon Bonds Tax Considerations. Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

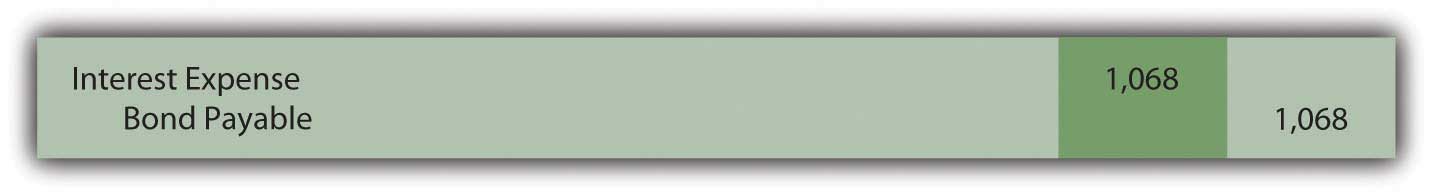

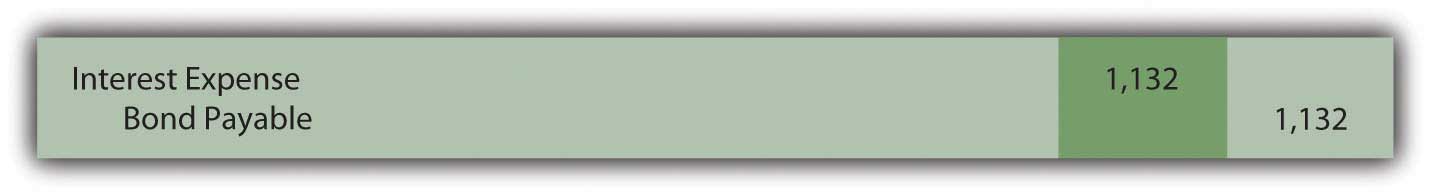

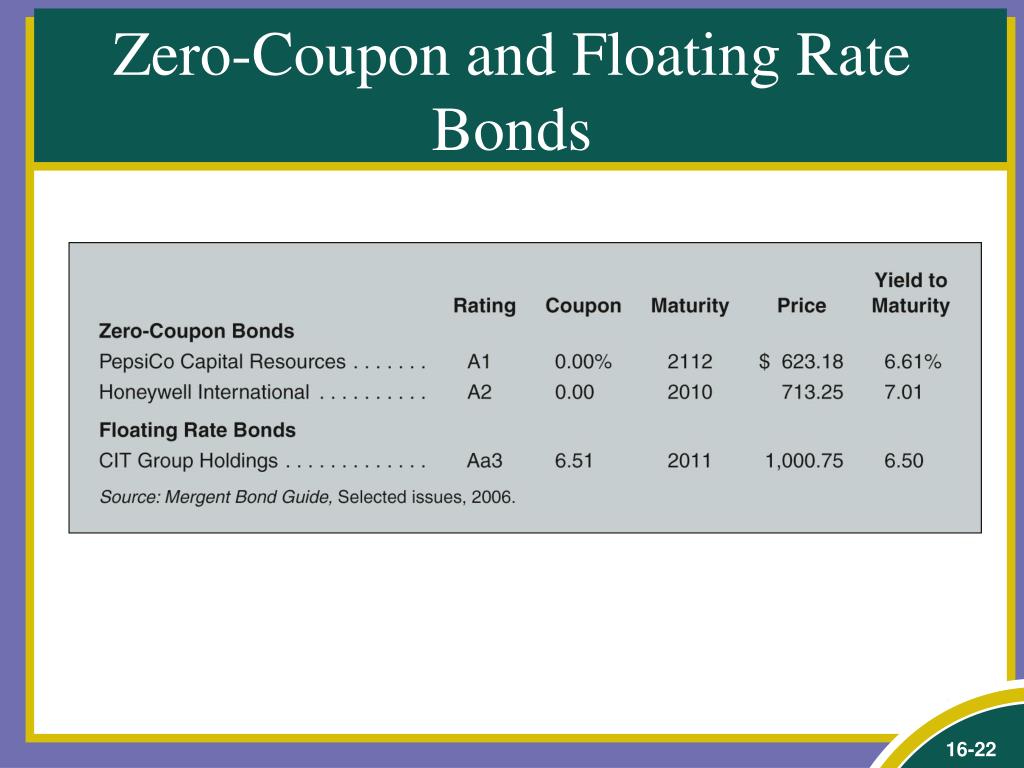

Are zero coupon bonds taxable. Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Tax Considerations for Zero Coupon Bonds - Financial Web Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between. Education investing--When you are investing to pay for a child's education, you could put the bond in his or her name. Do you pay taxes on zero coupon bonds? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket.

Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Tax Considerations for Zero Coupon Bonds Tax Considerations. Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

What is the tax implication on zero coupon bonds? - myITreturn Help Center Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. How is tax calculated on a zero coupon bond? - Quora Do you pay taxes on zero coupon bonds? Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people.

Post a Comment for "39 are zero coupon bonds taxable"