40 duration of a coupon bond

Duration - Definition, Types (Macaulay, Modified, Effective) What is Duration? Duration is one of the fundamental characteristics of a fixed-income security (e.g., a bond) alongside maturity, yield, coupon, and call features. It is a tool used in the assessment of the price volatility of a fixed-income security. Bond Duration: Everything You Need to Know - SmartAsset How Coupon Rate Impacts Duration. Coupon rate is the interest yield of a bond. This is an annual rate. So if you have a $1,000 bond with a 5% coupon, you will earn $50 of interest from the bond each year (5% of $1,000). A bond will pay this amount in addition to its par value.

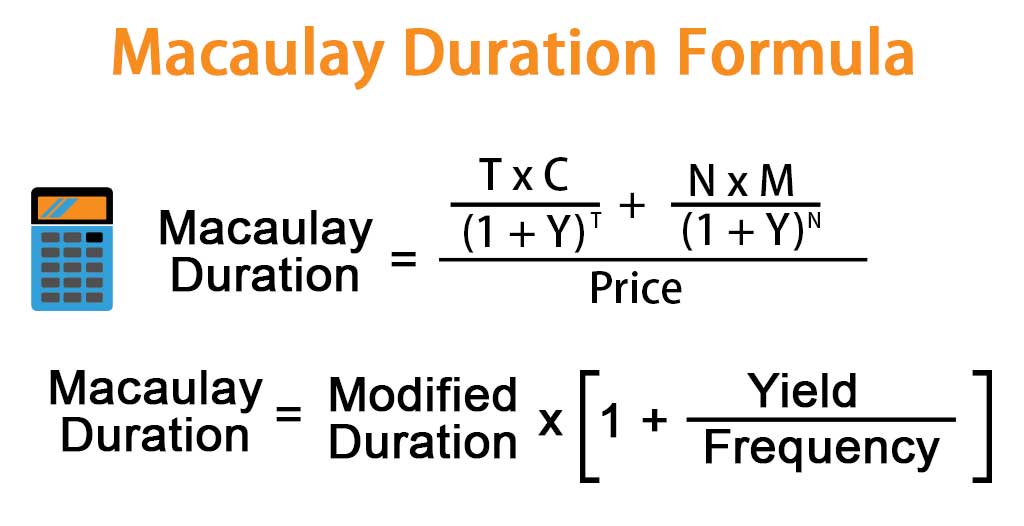

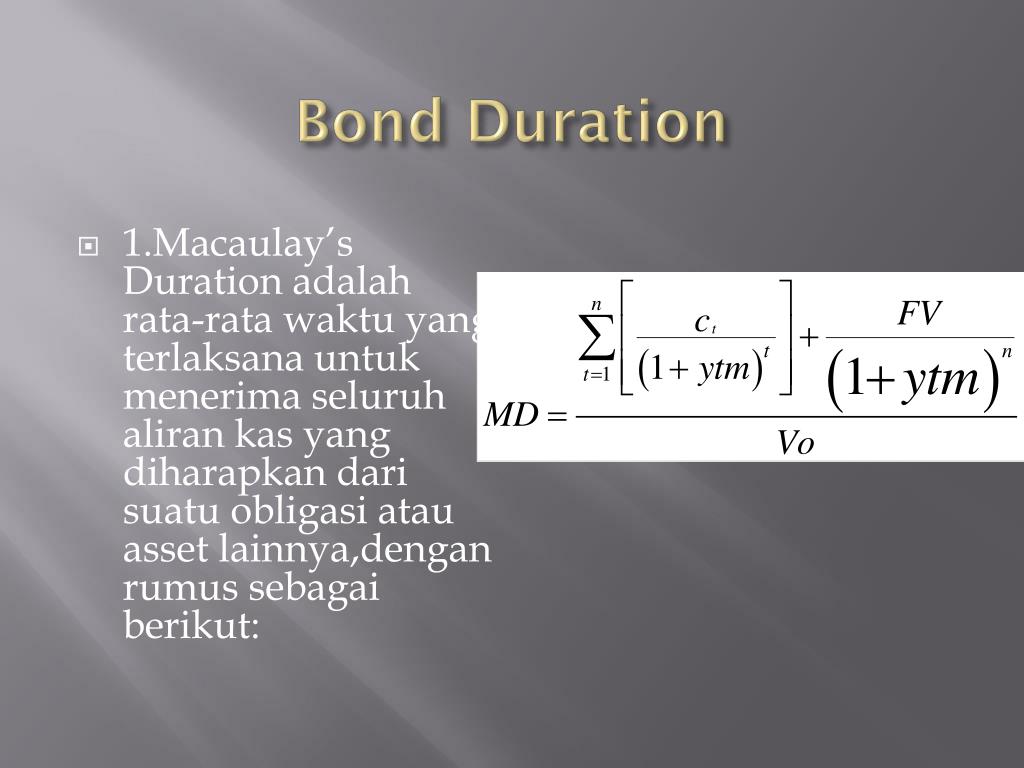

Macaulay Duration - Investopedia Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ...

Duration of a coupon bond

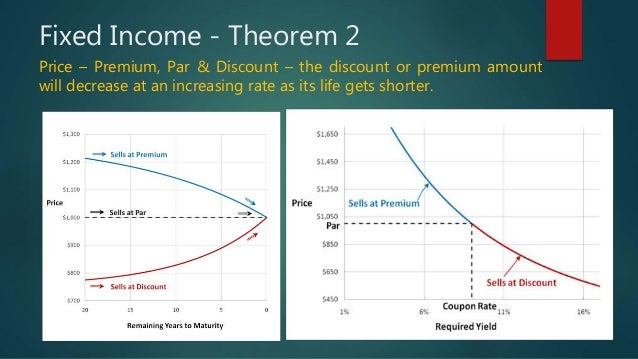

Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. Duration Definition - Investopedia Nov 11, 2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of...

Duration of a coupon bond. Understanding bond duration - Education | BlackRock It's lost some appeal (and value) in the marketplace. Duration is measured in years. Generally, the higher the duration of a bond or a bond fund (meaning the longer you need to wait for the payment of coupons and return of principal), the more its price will drop as interest rates rise. How duration affects the price of your bonds Duration Formula (Definition, Excel Examples) | Calculate ... Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Macaulay Duration - Overview, How To Calculate, Factors How to Calculate Macaulay Duration. In Macaulay duration, the time is weighted by the percentage of the present value of each cash flow to the market price. Bond Pricing Bond pricing is the science of calculating a bond's issue price based on the coupon, par value, yield and term to maturity. Bond pricing allows investors.

Bond Duration Calculator – Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ... PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of What is the duration of a bond? and How to Calculate It? Usually, the duration of a bond shows the number of years in which an investor can recover the present value of the cash flows of a bond. It can also represent a percentage that is a measure of how sensitive the value of the bond is to changes in interest rates. The duration of a bond is simple to understand. How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Bond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. Simply enter the following values in the calculator: Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%. How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder).

Duration of a Bond | Portfolio Duration | Macaulay & Modified Duration Therefore, the Macaulay bond duration = 482.95/100 = 4.82 years. And Modified Duration= 4.82/ (1+6%) = 4.55%. The above calculations roughly convey that a bondholder needs to be invested for 4.82 years to recover the cost of the bond. Also, for every 1% movement in interest rates, the bond price will move by 4.55% in the opposite direction.

Modified Duration - Overview, Formula, How To Interpret Below is an example of calculating Macaulay duration on a bond. Example of Macaulay Duration. Tim holds a 5-year bond with a face value of $1,000 and an annual coupon rate of 5%. The current rate of interest is 7%, and Tim would like to determine the Macaulay duration of the bond. The calculation is given below: The Macaulay duration for the 5 ...

What Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · When a coupon is added to a bond, the duration will always be less than its maturity. Short and Medium-Term Bonds. In a nutshell, the general rule is that for every 1% increase in interest rates ...

Post a Comment for "40 duration of a coupon bond"